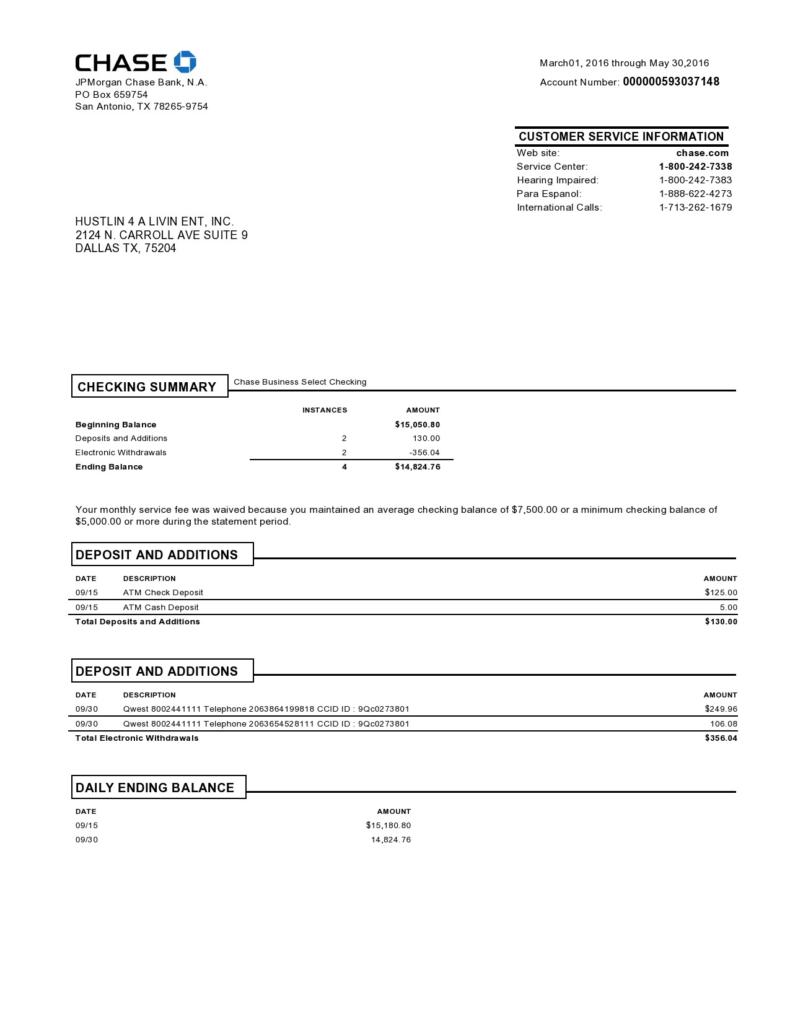

Bank Statements

A bank statement is a list of all transactions for a bank account over a set period, usually monthly. The statement includes deposits, charges, withdrawals, as well as the beginning and ending balance for the period. This API supports all bank statements formats similar to USA Banks

The

typeparameter isus_bank_statementfor the Upload endpoint.

Field Descriptions:

The model automatically detects data such as:

| Information Category | Field Name | Data Type | Description |

|---|---|---|---|

| Basic Information | Account Name | String | Account holder's name |

| Basic Information | Account Number | String | Account number |

| Basic Information | Bank Name | String | Bank name |

| Basic Information | Opening Balance | Number | Opening account balance |

| Basic Information | Closing Balance | Number | Closing account balance |

| Basic Information | Start Date | Date | Start date of the account |

| Basic Information | End Date | Date | End date of the account |

| Basic Information | Account Address | String | Address associated with account |

| Basic Information | Account Type | String | Type of account |

| Basic Information | Tally Check | String | Tally check |

| Basic Information | Document Type | String | Type of document |

| Error | Error Message | String | Error message description |

| Transactions | Line Items | Table | List of transaction line items |

| date | String | Transaction date | |

| check_no | String | Check number | |

| description | String | Transaction description | |

| debit | String | Debit amount | |

| credit | String | Credit amount | |

| balance | String | Balance after transaction | |

| amount | String | Transaction amount | |

| type | String | Transaction type | |

| category | String | Transaction category | |

| subcategory | String | Transaction subcategory | |

| merchant | String | Merchant information |

Features and Coverage

Features

- Transaction Tables Recognition: The API accurately identifies and picks up transaction tables from the input data.

- Duplicate Data Removal: The API effectively removes any duplicated check data, ensuring clean and unique information.

- Automated Processing: The API utilizes opening and closing balances to process documents without human intervention, increasing efficiency.

- Balance Tables Utilization: The API also picks up balance tables and uses them for post-processing tasks.

- Comprehensive Checks: The API performs three types of balance checks – daily balance, running balance, and opening/closing balance checks, ensuring accurate and reliable results.

Limitations

- Page Limitations: The API can process individual files with a maximum of 25 pages and combined files with a maximum of 400 pages.

- Table Requirements: Tables must have a Date column and either a Description or Check No. column for the API to recognise and process them.

- Amount Specifications: The API supports three ways of specifying amounts in tables: single amounts with +/- signs, separate debit and credit columns, and amounts with debit or credit specified by the title.

- Title Locations: The API can recognize titles placed above the table, on the left of the table, between lines indicating the type of data that follows, or in a dedicated title column within the table.

- Additional Columns: The API can utilize extra columns for other purposes, such as a balances column for tallying running balances. However, these columns may not be supported for all functionalities.

Our API does not fully support Credit Cards and Credit Unions. Rest assured, our development team is actively working on extending our capabilities to include these financial documents. As we continue to enhance and expand our offerings, we will promptly notify our valued users once support for Credit Cards and Credit Unions is implemented.

Coverage

While we showcase compatibility with a select list of banks, our API is engineered with a generic framework, empowering it to support data extraction from a vast array of financial institutions that we may not have explicitly tested on.

If you encounter a situation where the bank you intend to work with is not listed, or if the extraction process is not functioning as expected, please do not hesitate to reach out to our dedicated support team. We are committed to assisting you with any necessary customizations that will accommodate your specific requests and ensure a seamless integration with the financial institution of your choice.

Actors Federal Credit Union

Addition Financial Credit Union

Affinity Credit Union

Ahli United Bank of Kuwait

All In Credit Union

Ally Bank

Amalgamated Bank

AmegyBank of Texas

American Airlines Credit Union

American Express

Ameriprise Financial

Apple Bank

Arvest

Assiniboine Credit Union

Astoria Bank

ATB Financial

Atlantic Union Bank

axos ΒΑΝΚ

Bank Maybank Indonesia

Bank of America

Bank of Hawaii

Bank of Jersey

Bank of Marin Bancorp

Bank of Montreal

Bank of Scotland

Bank of the West

Bank United

BankPlus

BAR HARBOR BANK & TRUST

Barclays

BB&T (Branch Banking and Trust Company)

BECU

Bethpage Federal Credit Union

Blue Ridge Bank

BMO Bank

BMO Financial Group

BMO Harris Bank

BNY MELLON

Bremer Bank

California Coast Credit Union

Canadian Western Bank

Capital One

Carter Bank & Trust

Carver Federal Savings Bank

Cathay Bank

Cecil Bank

Central Bank

Charles Schwab

Chase

CIBC

Citibank

Citizens Bank

City Employees Credit Union

City National Bank

Coast Central Credit Union

Columbia Bank

Comerica Bank

Commerce Bank

Community America CREDIT UNION

Community FEDERAL CREDIT UNION Kelly

Conexus Credit Union

CONGRESSIONAL FEDERAL

Coutts

Credit Suisse

Credit Union Of Texas

DBank

Delta Community Credit Union

Deutsche Bank

Digital Federal Credit Union

Dime Community Bank

East West Bank

Eastern Bank

Elevations Credit Union

Emprise Bank

ENT

EQ Bank

ESL Federal Credit Union

Federal Savings Bank

Fifth Third Bank

First American Bank

First Citizens Bank

First Farmers Bank and Trust

First Hawaiian Bank

First Horizon Bank

First National Bank

First State Bank

FirstBank Holding Co

FirstOntario

Flushing Bank

Frisco Texas Republic Bank

Frost Bank

Fulton Bank

Gesa Credit Union

Grasshopper Bank

Greeneville Federal Bank

Gulf & Fraser

HALIFAX

HSBC

Huntington National Bank

ID Bank

Innovation Credit Union

JPMORGAN CHASE & Co.

JPMorgan Chase Bank

Key Bank

La Mission Federal Credit Union

Langley Federal Credit Union

LAW ENFORCEMENT

Liberty Bank

Libro Credit Union

Lincoln Savings Bank

Live Oak Bank

LLOYDS BANK

M&T Bank

Marcus By Goldman Sachs

Mascoma Bank

Mcu Municipal Credit Union

Merchants Bank

MERCURY

Meridian Bank

Merrick Bank

Metro Bank

MidFirst Bank

MIDFLORIDA Credit Union

Mission FED CREDIT UNION

Mountain America Credit Union

Municipal Credit Union

NatWest

Navy Federal Credit Union

Nevada State Bank

New York Community Bank

Northrim Bank

Novo

ONE Bank PLC

OREGONIANS CREDIT UNION

Partners Federal Credit Union

Pathward

Peach State Federal Credit Union

PlainsCapital Bank

PNC Bank

PNC Financial Services

Popular Bank

Prosperity Bank

Provident Credit Union

PROVINCIAL CREDIT UNION LIMITED

PSECU

Raymore Credit Union

RBC (Royal Bank of Canada)

RBFCU

Regions Bank

Regions Financial Corp

Ridgewood Savings Bank

Robins Financial Credit Union

Royal Bank of Canada

Salem Five

Santander Bank

Scotiabank

Seattle Credit Union

Servus Credit Union

South State Bank

SPACE COAST CREDIT UNION

STAR ONE CREDIT UNION

Starling Bank

Sterling National Bank

SunTrust

Synchrony

Tampa Bay Federal Credit Union

Tangerine

TD Bank

TDECU YOUR CREDIT UNION

Texas Bank and Trust

Texas Capital Bank

Texas Republic Bank

Texas Trust Credit Union

The Bank of New York Mellon

The Northern Trust Company

TIAA

Travis Credit Union

Truist

Truliant Federal Credit Union

U.S. Bank

UMB

UnionBank

United Bank

United Texas Credit Union

USAA Federal Savings Bank

Utah Community CREDIT UNION

Vancity

Varo Bank

VE DBank Americas Most Convenient Bank

VIRGINIA Credit Union

VyStar Credit Union

Wachovia

Webster Bank

Wells Fargo

WesBanco

West Texas National Bank

Windsor Federal

Woodforest National Bank

Yampa Valley BankVersion

- 1.1.0

Error Codes

For a detailed list, check the review-tips section

| Error | Description | Action |

|---|---|---|

| Error in Server | Something failed on the server side | Contact the support team |

| ERR_TRANSACTION_DISCREPANCY_XX | Discrepancy identified in transactions list | Look for a table with review required cells, correct the value, re-run the validation |

| ERR_OPENING_CLOSING_BALANCE_DISCREPANCY | No discrepancy in transactions found, so likely the opening and closing balance was wrong | Update the opening closing balance, re-run the validation |

| For Acc: 0 ERR_TALLY_PASSED, For Acc: 1 ERR_TRANSACTION_DISCREPANCY | Account wise error list | Take action according to the error message corresponding to the account |

Error Codes details

Format of the error message:

ERR_<MESSAGE>_<METAINFO>e.g. ERR_TRANSACTION_DISCREPANCY_01

**Inference -> Document was extracted through bank statement and there was some discrepancy in transaction that was verified.

METAINFO identifies what extractors were used and can be used by developers for quick debugging in case of issues or bugs. For all practical purposes, clients can ignore this metainfo and discard it by discarding last two numeric digits of the error message

| Type of Extractor | Code |

|---|---|

| Bank Statement Extraction | 01 |

| Credit Card Extraction | 02 |

| Consolidated Extraction | 03 |

| Delta Community Special Extraction | 11 |

| Waukesha Special Extraction | 12 |

MESSAGE will give more information of the status of the extraction

ERR_TRANSACTION_DISCREPANCY

there was some discrepancy in the transactions which has been marked

ERR_OPENING_CLOSING_BALANCE_DISCREPANCY

the opening and closing balance were not extracted confidently, we were not able to mark the discrepancy in the transactions.

Consolidated Statements -

The error message formatting remains the same. The only difference is that a consolidated statement, will have information pertaining to multiple account types, the error messages would reflect the value for individual account type.

E.g.

Lets say we have two account types in a given document. One account type passed the Tally check while other had issue in transactions, then the message should look like this-

For Acc: 0 ERR_TALLY_PASSED, For Acc: 1 ERR_TRANSACTION_DISCREPANCY

ERR_OPENING_CLOSING_BALANCE_DISCREPANCY

There was a discrepancy with the extraction of opening and closing balances. This could be due to the following reasons:

- Opening or Closing balance not being extracted or being present in the document

- Opening or Closing balances are extracted, but might be incorrect due to the complex structure of the document

DATE_TALLY_FAILED or DATE_OUT_OF_BOUND

Only present when the strict_stp is enabled (i.e. the value is true).

This error message is added to the Error Message value when there is one or more extracted transaction dates not within the range of the extracted starting and ending dates. This indicates the transactions were extracted which might not belong to the current extracted statement period.

NO_VALID_YEAR_FOUND

If the strict_stp, the additional parameter is set to true, and the extractor was not able to find a valid year within the extracted dates, the error message NO_VALID_YEAR_FOUND might be shown.

No tables extracted or No tables generated

The extractor was unable to extract any transaction tables with the proper columns and row structure.

Sample

Sample Json Output

{

"data": {

"Basic Information": {

"Account Name": {

"value": "",

"position": [],

"confidence": 1.0,

"review_required": false

},

"Account Number": {

"value": "",

"position": [],

"confidence": 0,

"review_required": true

},

"Bank Name": {

"value": "",

"position": [],

"confidence": 0,

"review_required": true

},

"Opening Balance": {

"value": "",

"position": [],

"confidence": 0,

"review_required": true

},

"Closing Balance": {

"value": "",

"position": [],

"confidence": 0,

"review_required": true

},

"Start Date": {

"value": "",

"position": [],

"confidence": 0,

"review_required": true

},

"End Date": {

"value": "",

"position": [],

"confidence": 0,

"review_required": true

},

"Account Address": {

"value": "",

"position": [],

"confidence": 0,

"review_required": true

},

"Account Type": {

"value": "",

"position": [],

"confidence": 0,

"review_required": true

},

"Tally Check": {

"value": "",

"position": [],

"confidence": 0,

"review_required": true

},

"Document Type": {

"value": "auto",

"position": [],

"confidence": 1.0,

"review_required": false

}

},

"Error": {

"Error Message": {

"value": "E_FILE_IO",

"position": [],

"confidence": 0,

"review_required": true

}

},

"Transactions": {

"Line Items": [

{

"date": {

"value": "",

"position": [],

"confidence": 0,

"review_required": true

},

"check_no": {

"value": "",

"position": [],

"confidence": 0,

"review_required": true

},

"description": {

"value": "",

"position": [],

"confidence": 0,

"review_required": true

},

"debit": {

"value": "",

"position": [],

"confidence": 0,

"review_required": true

},

"credit": {

"value": "",

"position": [],

"confidence": 0,

"review_required": true

},

"balance": {

"value": "",

"position": [],

"confidence": 0,

"review_required": true

},

"amount": {

"value": "",

"position": [],

"confidence": 0,

"review_required": true

},

"type": {

"value": "",

"position": [],

"confidence": 0,

"review_required": true

},

"category": {

"value": "",

"position": [],

"confidence": 0,

"review_required": true

},

"subcategory": {

"value": "",

"position": [],

"confidence": 0,

"review_required": true

},

"merchant": {

"value": "",

"position": [],

"confidence": 0,

"review_required": true

}

}

]

}

}

}Updated 4 months ago